Next Cryptocurrency To Explode Tuesday, February 27 – Optimism, Helium, Aptos

The crypto market started this week with relative uncertainties. However, the trend took a new turn yesterday after BTC broke the $52k ceiling. In the last 24 hours, the value of BTC and several other cryptocurrencies is rising.

What are the next cryptocurrencies to explode? With the return of optimism to the crypto market, investors are on the lookout for the next big gainers. Below are quick highlights of some of the top performers in the market today.

Next Cryptocurrency To Explode

Joining the ranks of upcoming crypto projects is the Green Bitcoin. The project recently kicked off its presale offering, and investors are already throwing in their hats in anticipation of its exchange listing. The details of the new project and its prospects are covered in the article.

1. Aptos (APT)

The bull market is allowing Aptos holders to rake in worthwhile ROI. After extended periods of declining price action, APT is back on an uptrend with over 20% gains in the last 24 hours. It also recorded a trading volume increase of 104% in the said period, signifying growing interest in the token.

Even though Aptos faces intense competition from established Layer 1 platforms, it is gradually gaining increasing use cases. More recently, it has deepened its hold in Asian countries with growing partnerships and events to show for it. A post on the official Twitter handle highlights the move.

Ultimately, the community would continue to drive towards more growth in the coming weeks. In the meantime, investors can look at APT for short-term market movement as the token and its investors continue to push toward explosive gains.

Ready for #AptosDeFiDays alpha? 👀

The Aptos Foundation is lining up the program, and our friend @StaniKulechov from @Aave will officially be joining us to talk all things DeFi! https://t.co/8kftCGsuh1

— Aptos (@Aptos_Network) February 26, 2024

Conversely, investors might brace for intense reversals in the APT trends in the coming quarters. Several indicators reveal that the token might encounter sell pressure as long-term holders look to profit. Besides, future token unlocking may also impact the token’s price since less than 50% of the token is currently in circulation.

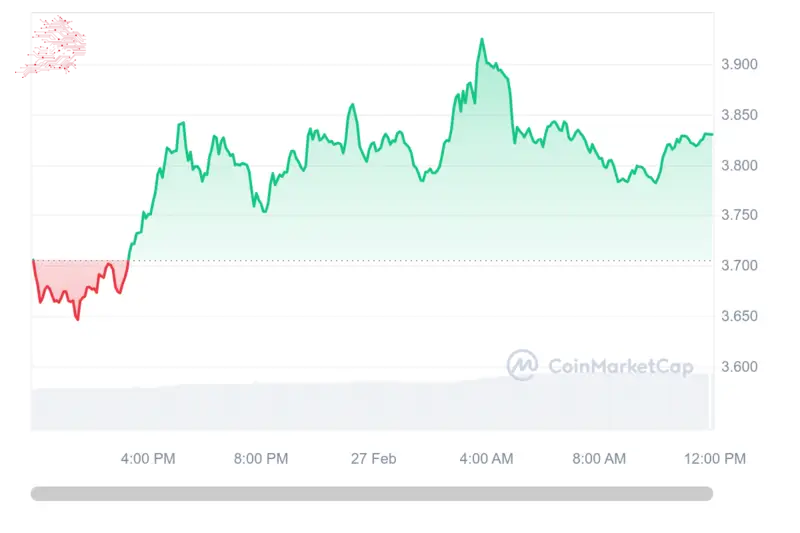

2. Helium (HNT)

While technically possible, mining cryptocurrencies on smartphones is generally impractical and inefficient. Is Helium promoting an innovative mining approach and network infrastructure via a decentralized wireless network? Strange as it may sound, miners can mine cryptocurrencies without relying on expensive infrastructure. Helium Network has made it possible by allowing nodes to act as hotspot devices.

The Helium team is putting a twist on the mining narrative by replacing the known power-intensive and cost-intensive systems with simple blockchain models that require lesser complexity but offer similar security and efficiency.

It leverages the decentralised wireless network where nodes serve as hotspot devices. Interestingly, the project received a wide welcome, especially with the growing interest in the DePIN sectors. Likewise, the project is seeing a rise in use cases and partnerships, which would likely push the value of its token, HNT, even higher.

The token returned to its glory days with over 242% price increase in the last 52 weeks; a large part of that gain was accrued in the last quarter of the previous year and the first few weeks of this quarter.

🎉🎉 @particle just announced M-Series, their new platform that adds Helium connectivity to their portfolio of products. This is exciting news for the developer community. Wireless applications can now be built using WiFi, Cellular, Satellite, and LoRaWAN connectivity seamlessly.…

— Helium🎈 (@helium) February 22, 2024

In the last 24 hours, the token recorded over 10% increase in price and close to a 150% increase in trading volume. The changes in price action come at the heels of the sudden surge in the price of BTC, which is currently approaching its halving month.

Investors should keep an eye on the Helium trend as it can hold its gains even after the BTC rally. The growing interest in the DePIN sector might continue much into the future, giving tokens HNT the chance to maintain price increases.

3. Green Bitcoin (GBTC)

The current Bitcoin pump is not all we’ll see in the market as the halving month approaches. Investors would see complementary trends, particularly new projects riding the Bitcoin wave to remarkable success.

Did you know you can earn HUGE, simply by staking your Green Bitcoin?

If you haven't yet, go to our website and check out the Staking feature! pic.twitter.com/6wiv99ER0O

— GreenBitcoin (@GreenBTCtoken) February 25, 2024

One such initiative is the Green Bitcoin project, which is currently on the runway and will take off from the sun. It provides green staking services that reward users up to 100% bonuses when they successfully predict Bitcoin Trends. The gamified approach gives users new challenges every week, increasing the chance of amassing more rewards.

Green Bitcoin Services and its staking offer are exclusively available to holders of the GBTC token. Interestingly, the staking offers a reward of up to 261% APY. At press time, over 2.2 million GBTC have been staked, according to its website.

The opportunity to participate is still open, and the price is currently $$0.492. The price will increase in a few hours, and investors might have to part with more than that to join the offer.

Moreover, the project is getting closer to its listing date, which presents the chance to earn some return on the initial pump. The GBTC presale page provides further details.

Visit Green Bitcoin Presale

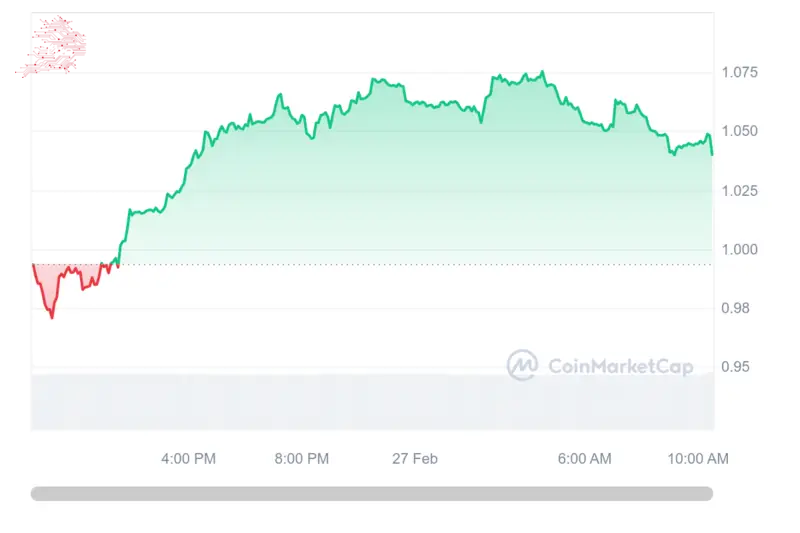

4. Polygon Ecosystem Token (POL)

Polygon is home to some of the best-performing Crypto projects currently. Thus, the token reflects the trends of its ecosystem. More importantly, it also enjoys the growing visibility of the Ethereum ecosystem in anticipation of the Eth ETFs and the Dencun upgrade. Polygon is also going through a series of upgrades to ensure improved security and efficiency in the network.

Evidently, the price of POL in the last 24 hours mirrors the price action of Eth, which has increased by about 4%. On the other hand, POL is up by approximately 7% today, complemented by a volume increase. Investors should expect more explosive gains in the coming quarters as Polygon explores real-world asset tokenization opportunities.

Do you have questions about the Elderberry upgrade?

Come discuss the latest upgrade for Polygon zkEVM on the forum, where there are no hashtags and no one tries to dunk on you.https://t.co/kShWawRFnM https://t.co/3UyOrKNqlG

— Polygon | Aggregated (@0xPolygon) February 26, 2024

The move will likely open and unlock the network’s potential and attract more visibility to the tokens in the ecosystem. Meanwhile, investors should keep an eye on the trend to see the direction of its price actions in the coming days.

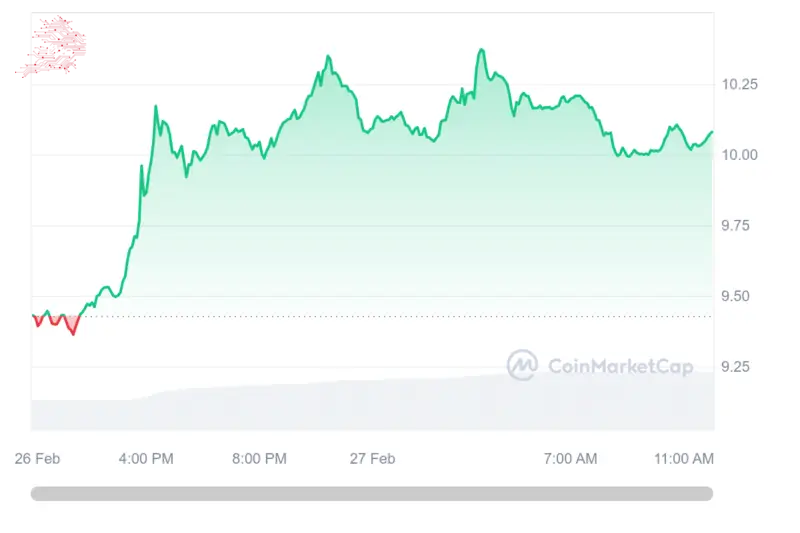

5. Optimism (OP)

Optimism token OP is notorious for its high volatility. However, the token recently witnessed an impressive surge that caused a 27% increase in price. However, the volatility of the OP token took effect, resulting in a quick price decline.

Nevertheless, OP is signally a return to the uptrend, and it might be the next crypto to explode. Many technical indicators of the asset, particularly its oscillations, remain neutral at the time of writing. Meanwhile, its price trends are below its long-term moving averages. With that, investors can expect a price movement to the upside in the coming days.

Conversely, the long-term prospect of OP token hangs in the balance as its circulating supply is currently below 25% of the total supply. It means that each succession of tokens would result in a price decline until the unlock is fully vested. The unlock timeline spans five years, starting from 2022.

Hence, holders might have to endure fluctuating prices for the duration. Alternatively, OP may serve as a hedging opportunity for short-term gains, especially as the Ethereum ecosystem is set to witness an influx of funds.

Read More

- Next Cryptocurrency To Explode 2024

Comments

Post a Comment