BRICS: UAE Pays China With New Digital Dirham, Ditches US Dollar

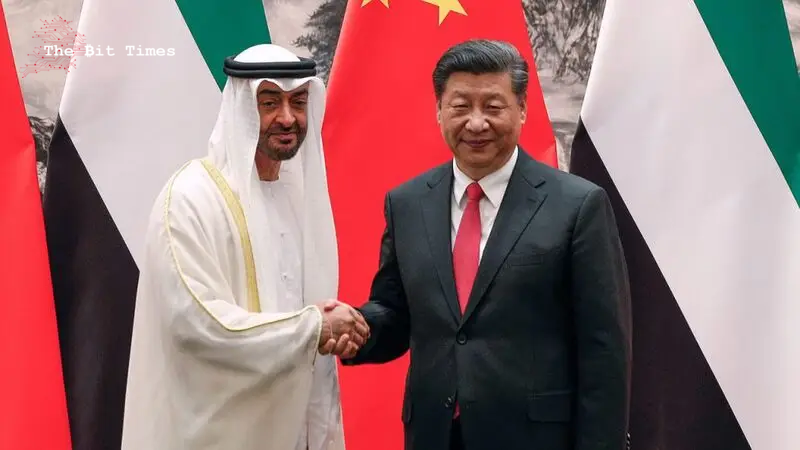

BRICS members UAE and China settled a cross-border transaction on Monday using the new Digital Dirham sidelining the US dollar. This is the first-ever transaction made directly to China from the UAE using the new mode of payment with the Digital Dirham. The direct trade settlement was initiated by the UAE through the ‘M Bridge’ platform making ways for BRICS to end reliance on the US dollar through digital methods.

Also Read: BRICS: Russia Building New Payment System Without U.S. Dollar

The UAE Central Bank initiated the Digital Dirham payment to China amounting to Dh500 million, which is equivalent to $136 million. Shaikh Mansour conducted the historic transaction directly to China showcasing the ‘M Bridge’ payment platform.

The live trade settlement was also attended by the UAE’s Central Bank officials and graduating students comprising 1,056 Emiratis. The development indicates that the UAE is ushering in a new era of digital payments.

Also Read: BRICS Expansion a Threat To SWIFT Payment System & US Dollar

BRICS: UAE & China’s Usage of Digital Dirhams Threatens US Dollar

The BRICS countries UAE and China have trade agreements worth billions of dollars and using the Digital Dirhams as payment jeopardizes the US dollar. If the two BRICS nations stick to payments in the Digital Dirhams, the US dollar will be the hardest hit. Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade.

Also Read: BRICS: Morgan Stanley Predicts Future of the U.S. Dollar

The new BRICS member UAE is looking at innovative methods to put the Digital Dirham ahead of the US dollar. Additionally, China is encouraging developing nations to put their local currencies first for trade settlements and sideline the US dollar. The UAE’s Central Bank has also launched the ‘Innovative Projects’ scheme which aims to promote the Digital Dirham extensively.

All these developments indicate the US dollar could be less used by BRICS for trade settlements in the coming years. Moreover, the move will directly impact the US economy and the dollar could lose the global supply and demand mechanism.

Comments

Post a Comment