Bitcoin Miners Offload 1K BTC as Price Slides Below $27K

Bitcoin [BTC], the world’s largest cryptocurrency, has been struggling to find support at $27K. Time and again, the asset was seen falling below this level, causing chaos in the market. At press time, the king coin was trading for $26,408.53, a dainty increase of 0.71%.

The significant drop in Bitcoin’s price can be attributed to a range of factors, including macroeconomic influences that have had a substantial impact on BTC. One such factor is the ongoing concern surrounding the debt ceiling in the United States, which has negatively affected the price of the crypto. Several have been highlighting the possibility of BTC plummeting even further if the debt ceiling crisis continues.

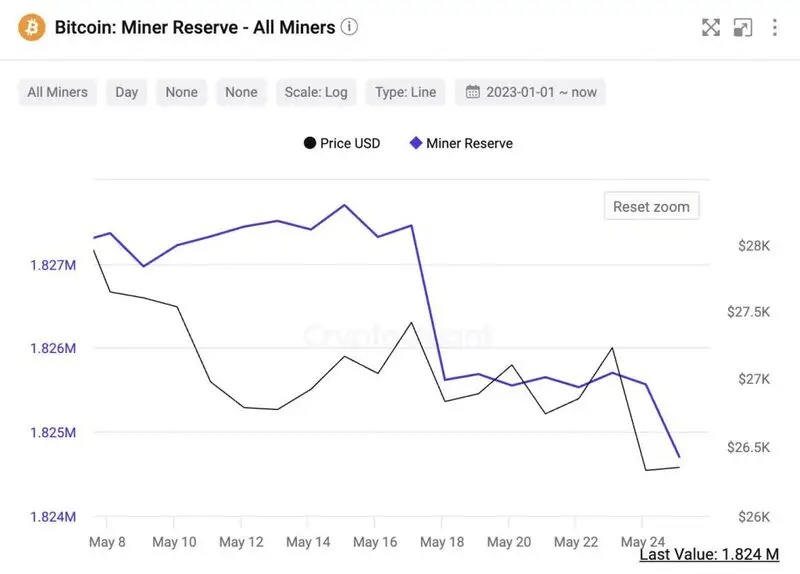

Additionally, Bitcoin miners have been noted selling off their holdings, further adding to the downward pressure on BTC’s price. The combination of these factors has played a role in the recent decline in the value of Bitcoin.

Crypto analyst Ali took to Twitter to notify the community that Bitcoin miner reserves were being “depleted.” He further revealed that miners had sold a whopping 1,000 BTC, worth about $27 million. This increased selling occurred in the last 24 hours alone.

It is commonly perceived that when Bitcoin miners engage in significant sell-offs, it can have a negative impact on the market. Such sell-offs can create downward pressure on the price of Bitcoin, contributing to its decline.

Are investors buying the Bitcoin dip?

With the U.S. economy crumbling and de-dollarization taking center stage, several have been stressing the importance of buying BTC. Now that Bitcoin is trading at discounted prices, it is considered an ideal time to pocket the king coin.

However, the market isn’t quite on board with this trend. According to Santiment, the ‘buy the dip’ notion has taken a backseat.

🫢 We are seeing the common paradox of traders buying short-term, small #crypto price dips, but scared to buy the longer-term bigger ones. Mentions of #buythedip or #boughtthedip are dormant. Historically, this kind of #FUD has been good to capitalize on. https://t.co/7a2OSKDTCO pic.twitter.com/HwQznJYsYk

— Santiment (@santimentfeed) May 25, 2023

The reduced enthusiasm for “buying the dip” may suggest a cautious or uncertain sentiment among the community regarding the short-term prospects of Bitcoin.

Comments

Post a Comment