Short squeeze alert for December 12: Two cryptocurrencies with potential to skyrocket

Bitcoin (BTC) and most of the top cryptocurrencies experienced a price retracement earlier this week. With a momentary sentiment shift from bullish to bearish, short positions increased in the cryptocurrency market.

In this context, Finbold retrieved data from CoinGlass’s long/short ratio on December 12. Interestingly, two cryptocurrencies could face an imminent short squeeze, driving prices upwards amid the shifting market movements.

Particularly, Uniswap (UNI) and Aave (AAVE) have seen a relevant increase in the opened short positions in the last 12 and 24 hours. Both are among the most popular decentralized finance (DeFi) protocols with multi-chain support.

Short squeeze alert for Uniswap (UNI)

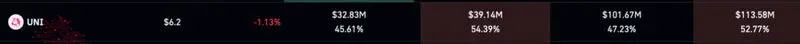

Uniswap has the most relevant short-sellers volume and short position weight against the opened long positions. In the 12-hour time frame, UNI registers $39.14 million shorts over the $32.83 million longs, for 54.39% of the former.

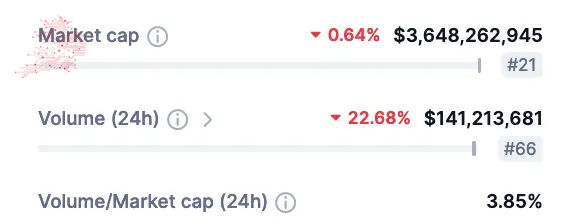

However, its overall relevancy is mostly in the 24-hour period, with $113.58 million shorts (52.77%) opened. This is almost the same amount as its daily exchange volume of $141.21 million, according to CoinMarketCap.

Therefore, a sentiment shift on Uniswap could trigger a massive short squeeze on UNI, considering its current liquidity.

Will Aave (AAVE) face a short squeeze?

In the meantime, the Aave Protocol is also being targeted by cryptocurrency short-sellers. Its token AAVE has $28.21 million, and $75.03 million short positions opened in the last 12 and 24 hours, respectively. Interestingly, this means a 54.29% and 53.10% respective dominance against longs.

Despite having a higher weight on its long/short ratio, a short squeeze for AAVE would probably have a lower impact on price than UNI’s. This is due to a higher 24-hour exchange volume of $122.16 million in comparison with the daily shorted positions.

At the time of publication, Uniswap and Aave are trading at $6.2 and $91.76 per token, respectively.

Notably, cryptocurrency traders are eagerly expecting an altseason, which both digital assets could help trigger after a short squeeze, which occurs when these bearish positions get liquidated, facing a surge in demand and price. The increased demand causes a high volume of buy orders to liquidate exchange books, pumping the price and triggering derivative contracts for liquidation, driving the price even further.

All things considered, there are no guarantees that such an event will happen with these cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment