Bitcoin hits new yearly high; What’s next for BTC price?

In a period that has been positive for most cryptocurrencies, Bitcoin (BTC) performed as well. This flagship crypto hit its yearly high, climbing to a milestone of $36,800.

Offering us another valuable insight, crypto analyst Michaël van de Poppe shared his thoughts on the BTC’s new yearly high, announcing a bull cycle and forecasting where Bitcoin’s price is headed in the future, in his post on X on November 9.

Poppe noted:

“It’s expected to see Bitcoin reach $45,000-50,000 pre-halving, after which we’ll have a heavy correction back to $32,000-35,000 and consolidate from there.”

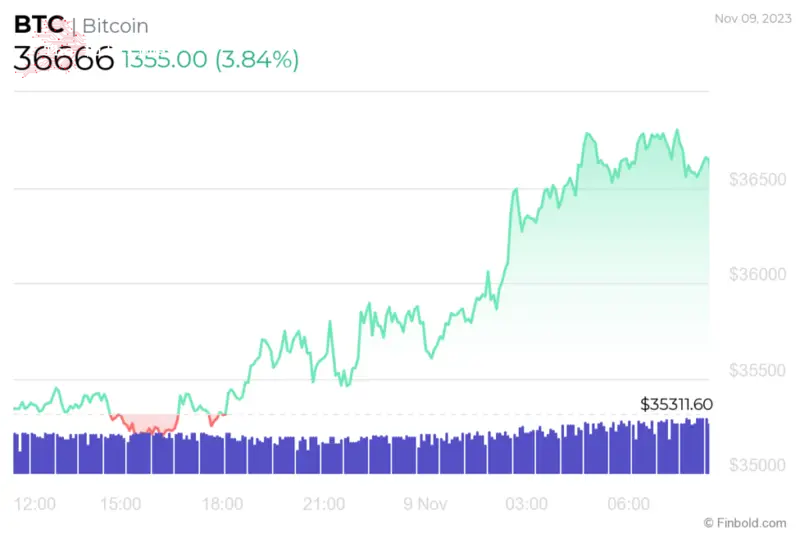

BTC is currently trading at $36,666, marking a 3.84% positive change in the past 24 hours, topping the 3.96% gains made over the previous 7 days and the impressive 32.58% rise over a month.

BTC market cycles

Continuing on his current Analysis, van de Poppe offers a prediction of the price movement of this famous crypto asset.

He claims that we’re stepping into the debut of the bull cycle, definitively putting the bear market behind us. Altcoins are gaining traction, and Bitcoin has surged past the $30,000 mark.

van de Poppe reminds us that crypto markets adhere to four-year cycles, each featuring distinctive phases: a red bear market, a green accumulation year, a purple bull phase 1, and a green bull phase 2 (the mania period).

The bear market spanned from November 2021 to November 2022, hitting its lowest point in November. Since then, the accumulation year has unfolded, and the current month signals the close of this phase.

Following this, we’ll transition into a year of bull phase 1. This phase typically sees Bitcoin steadily climbing without reaching its all-time high and occurs in the second year of the bull market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment